Looking for some guidance concerning form 1099-S. When acquiring property in the couple hundred dollar range, are you sending the form to the seller to file? If you're purchasing land for more than $600, are you doing anything differently? Thanks for sharing how you're handling it!

Have you seen this article, Bryan? It addresses some of those scenarios you're asking about.

Short answer: You don't have to worry about it if your deal is in the couple hundred dollar range.

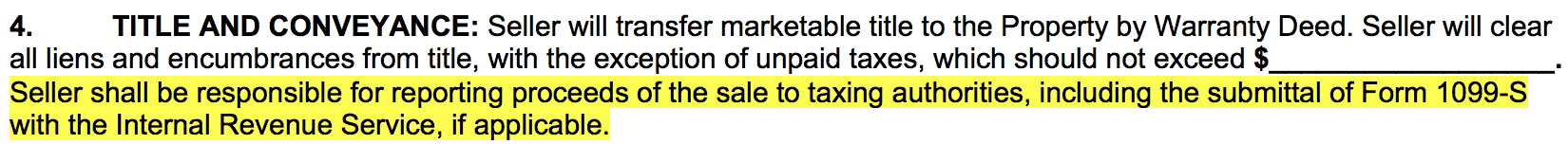

If the 1099-S is required in a buying situation, you can include this kind of clause in the PA to designate the seller as the responsible party:

@Bryan101025

Per the IRS instructions ( https://www.irs.gov/pub/irs-pd... ) " ... The $600 rule applies to the transaction as a whole, not

separately to each transferor..."

@Bryan101025 Those are words quoted from the IRS publication that covers 1099's. For an conclusive interpretation of the IRS publication, I'd recommend calling the IRS or consult a tax attorney or a CPA who is actively involved in the preparation of tax returns,

@retipsterseth I just posed the question regarding this clause to a Tax Professional on JustAnswer.com. Here's his statement:

"If the seller is required to issue the form according to the tax regulations - that clause just duplicates regulations and there is no value.

But if the seller is NOT required to issue the form - then he/she may choose to file or not regardless of that clause and that will not make any difference.

That clause doesn't protect you from your liability if any."

So, based upon what I researched in regards to 1099-S, the party that files the closing docs is responsible to file 1099-S. Since I am recording the deed, I will not use that clause and I will be sure to have Sellers complete the W-9 form and make sure that 1099-S form gets filed. A training program that I went through did not mention anything about the 1099-S form and that got me very nervous in preparing last year's income tax return. I had a few sellers that I retroactively tried to get the W-9 form completed and they blew it off, so I'm being diligent about getting this right to avoid fines.

@retipsterseth and everyone. I have this clause in my contract to buy (pushing responsibility to the seller), but nothing similar in my selling contract that pushes the responsibility to buyer. Can I just add this, and avoid the headaches, or is it as stated by @SUITEDCONNECTOR that the person recording the deed is responsible? I've only done a handful of self-closings with land, and wasn't even thinking about this!

Thanks in advance!