Any tips for getting around a Limited warranty deed? Title company will not give title insurance for 15 years. Any work arounds to sell this property at normal price instead of reduced price due to title?

Can you find whoever issued the Limited Warranty Deed and pay them a little money to sign a normal Warranty Deed for you?

You might also have better luck if you try a different title company. Some title insurance underwriters have different philosophies and standards about things like this (just because one underwriter is saying ‘no’ doesn’t mean they all will). You could even ask your existing title company to try a different title insurance underwriter.

Another idea: You could ask the title company to add this to the list of exceptions in the title commitment. In other words, they agree to insure over all the normal issues EXCEPT for any problems that might arise from this one imperfection in the chain of title.

Looks like the guys I bought it from bought it at a tax sale from the state. The state is the one that issued the Limited deed. I will check with some of the other title companies.

If that’s the issue, you should check out this podcast interview.

Depending on what state you’re in, you may have at least a couple of options for resolving that issue and getting it through title.

Ok I will watch this episode. Thank you

There is no reason they should insure the title. Previous owners never foreclosed out the right of redemption of the defaulters. But not to worry. All you have to do is sell it on a Limited Warrantee Deed which is what you should be doing anyway. This is a situation where the previous owners used a LWD to escape the previous lack of clear title. When you use the LWD you are doing the same thing. LWSD limits your responsibility to problems which occur during your ownership. Unless you created a title problem, you don’t have a problem. Resell it on a LWD and don’t worry about it.

Gotcha Thanks, issue being that so far everyone that has looked at it is a builder or someone that wants to build on it right away. builders won’t touch it if it can’t have title insurance and banks won’t lend on it is what seems to be happening.

I thought about that after I posted the post. But you can sell to a neighbor or anyone that doesn’t want to use it as a homesite. Another way to get rid of it. Sell it using owner carryback. But not to a builder.

This company specializes in helping pruchasers of tax deed property get titel insurance. Cost varies depending on the state but runs $2k to $2.5k.

I have not used them but have frequently seen post on various sites / forum over the years by those who have and were satisfied.

I am familiar with special warranty deeds–indeed I asked a question about them on this forum yesterday. I had never heard of Limited Warranty Deeds. Can someone explain the difference?

A Limited Warranty Deed limits the Warranty you are placing on the sale. There are two main differences. A General Warranty Deed guarantees the title against all title problems and says that you will stand behind the warrranty against all problems. A Limited Warranty Deed, as the name implies, is not as comprehensive. It is often used by banks, heirs, and people like that who might not know of all the problems that might have previously occurred. The second instance where they are used is where a corporation is selling property and their corporate charter prohibits them from offering blanket guarantees.

we went through title and abstract company and the property qualified for their program. then after paying $500 bucks for that a cash buyer bought it and didn’t care about the Limited Deed. just never know

You might be surprised, especially with properties in the sub-$10k range, a lot of buyers will accept a quit claim deed with no questions asked.

Maybe it’s because they property is so cheap, but I honestly think it’s because most of them understand the issue. This is why I always have them sign a Disclosure Statement to make sure they tell me in writing that they do understand what they’re doing and they won’t come back to me if they find problems in the future.

Of course, I’d never sell a property with a known title issue, but the whole nature of a quit claim deed keeps the liability off of me if some oddball thing comes up in the future.

Which title company did you use?

Do you have a link to that disclosure statement?

Brenda Flatter

Executive Director, National Sales

Title & Abstract Agency of America, Inc.

574-855-8968 | Mobile

bflatter@logs.com | www.titleandabstract.com

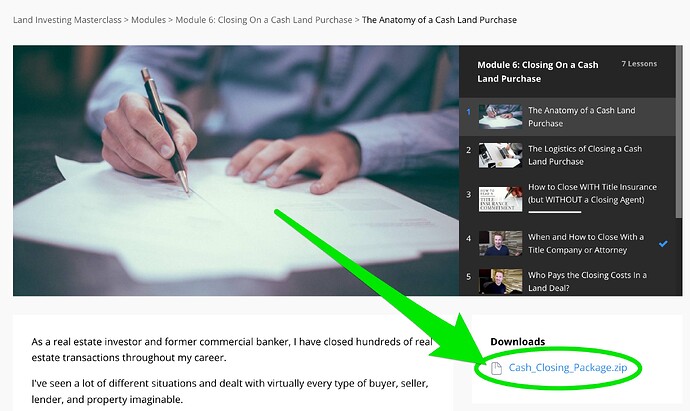

@dirtdeeds if you’re in the Land Investing Masterclass, you can get it as part of the Cash Closing Package, which you can download in Module 6, Lesson 1.

So you paid $500. Was that for Tax Title Certification? Which state was that property in?

$500 was for the Tax Cert. I think they have gone up to $550 and the Limited Warranty deed normally needs to be 10yrs old or older. After the process to make sure they can do the Tax Cert then there is a standard 30-45 day closing process and the sale needs to close with the Title company they choose in order to get Title insurance. The Property was in TN.

Hmm. $550. Brenda quoted me $1100 for TC on a cheap prop in AR. $550 is much easier to swallow.

How much was the sale and what were the closing costs?