@tylerd, congrats on purchasing your first property, and good luck with the first sale.

While I've heard (but haven't personally experienced) of some cases otherwise, most well-informed buyers would greatly prefer to close through a title company on warranty deed (or whatever the equivalent deed type may be in that state), as that gives them the greatest level of assurance that they're getting clear title to the property.

Just for some quick context/background on me, I'm trying to get, what would now become, my fourth property sale back on track, so I'm not claiming to be an expert with dozens of sales under my belt. That said, though, I have generally used the same general purchase and sale agreement template for both my purchases and resales; although, you'll want to reread it from the perspective of now being the Seller, and tweak any of the terms that you find appropriate, within reason and ultimately subject to the approval of your Buyer.

Off the top of my head, some examples of terms that you might want to change, between your purchase PSA and your sale PSA would include:

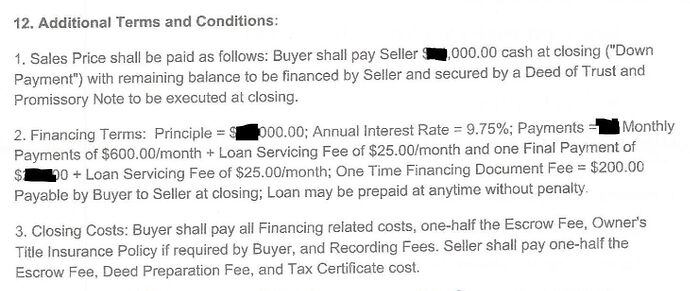

- Who covers closing costs? I.e. all Buyer, all Seller, some split (e.g. Seller covers prorated share of property taxes, all other closing costs borne by Buyer)?

- Earnest money deposit - if you don't have an EMD in your purchase PSA when you're the Buyer, maybe you want to add one when you're the Seller to try to weed out tire-kickers/time-wasters (or not; it's up to you)

- Ability for Seller to cancel the agreement - if you have a statement in your purchase PSA along the lines of, "Buyer may cancel this agreement at any time, for any reason" or something to that effect, you might consider whether you still want to explicitly state that when you're the Seller. In reality (while keeping in mind that I'm not a lawyer), this really doesn't matter a whole lot, anyway, since in most cases and jurisdictions, a Buyer can generally walk away from a PSA with the Seller's only recourse being that they get to keep the EMD, if there was any. The same is not true with a Seller being able to walk away, at will.

- Contingencies - As investors, often part of what we offer when we're buying property is a quick closing with no contingencies (notwithstanding the ability to cancel the agreement anytime, mentioned above), but when selling property, if you think you're dealing with a Buyer that intends to finance the property (quite possibly only an option if they're ready to build on it right away and have secured a construction loan), then they might expect to have a financing contingency in the agreement; basically saying that if they aren't able to secure financing of X% APR or better within Y number of days, they have the option to cancel the agreement. Personally, even if a Buyer was telling me they intended to get third party financing, I think I'd first leave this contingency out of the agreement, and only insert it if they specifically asked to do so. Just seems cleaner that way, and again, as mentioned above, other than the question of who gets the EMD, it's not like you would be able to force them to purchase the property if their financing fell through and they no longer wanted to buy it.

Aside from the above, I would also just say that if you wanted to, you could get your hands on the vacant land contract template put out by the Association of Realtors for whichever state the property happens to be in, and/or a contract template that the closing company you worked with might be able to provide. Then, don't necessarily scrap your own PSA that you used for the purchase, entirely, and go with the other one, but just read through it and see if any of the terms jump out at you as something that you'd prefer to include, now that you're the Seller.

Lastly, any time that you're in doubt, and especially with your very first sale in a state (or overall), consider hiring an attorney for a few hundred bucks to review your agreement and offer confirmation or edits.